LA Apartment Owners Face This Question When the Nation’s Last Major Eviction Ban Ends

The Los Angeles apartment eviction moratorium, one of the nation's longest-running pandemic-era tenant protections, is set to expire on Jan. 31, sparking a high-profile debate on whether its end will boost homelessness and apartment vacancies or, as some industry analysts suggest, have more muted effects.

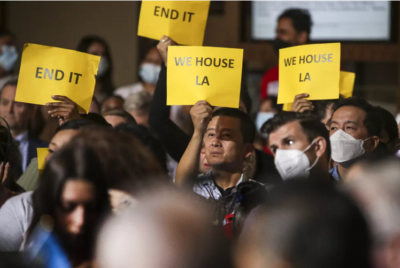

The Los Angeles City Council raised the question by voting in early October to end the moratorium in the second-largest U.S. city.